By 2026 the warehouse floor looks different than a decade ago: smaller teams, smarter machines, and a nervous but curious balance between human judgment and robotic precision. This post opens with a brief, human-scaled anecdote — a regional grocery chain manager who swapped overnight manual counts for drone-assisted inventory and shaved an entire weekend off stock reconciliation — then maps the five robotics advances turning that curiosity into measurable performance. The goal is practical: explain what each innovation is, how it works, the tangible productivity gains, implementation pitfalls to watch for, and realistic cost/ROI expectations. Plenty of numbers appear along the way (72% mispick reductions, 99.9% stock-count accuracy, RaaS deployment speedups) but the tone stays grounded and accessible. The result: a field guide for leaders who need to plan budgets, persuade stakeholders, and deploy robotics without losing the human touch.

Autonomous Mobile Robots (AMRs): Transport and Floor Efficiency

What it is and how it works

Autonomous Mobile Robots are a fleet of navigational robots that use SLAM, LIDAR, and AI path planning to move totes, carts, and pallets between pick zones, docks, and AS/RS interfaces. In 2026, this “robotic transport layer” is a core pillar of warehouse automation robotics, orchestrated by fleet software that assigns missions and avoids congestion.

Karen Li, Director of Warehouse Automation, BrightPick: “AMRs unlock floor efficiency by turning travel time into predictable, optimizable throughput.”

Key benefits for Autonomous Mobile Robots Transport

Reduced travel time and picker walking, improving throughput without removing people from the process.

Lower forklift dependence and fewer cross-aisle interactions; autonomous forklift pilots report ~70% safer environments (fewer incidents).

Higher utilization by smoothing peaks and cutting idle time through dynamic task assignment.

Implementation considerations

ROI depends on tight integration with WMS/WCS via API-based fleet orchestration, reliable Wi‑Fi, and clear traffic rules for mixed zones with humans and forklifts. Leaders also choose between battery-swap programs and charging docks, and define where safety fencing is required versus collaborative zones.

Cost and ROI: RaaS Deployment Acceleration

RaaS Deployment Acceleration makes AMRs accessible to mid-sized sites by shifting capex to opex; facilities report 3–5x faster rollouts with RaaS. Typical payback windows range from 12–36 months, depending on volume and travel distance.

Real-world applications

Common use cases include grocery replenishment lanes, e-commerce split-case transport, and automotive parts kitting to assembly lines.

Collaborative Robots (Cobots): Human-Robot Collaboration at Pick Stations

How collaborative robots work in picking

Collaborative robots (cobots) are lightweight robotic arms or mobile cobots designed to share space with people. At pick stations, they handle repeatable motions—presenting totes, holding cartons, applying labels, or placing items—using force-limited movement and teach-by-demonstration programming. This makes them well suited to mid-volume, high-variability workflows where full automation is hard to justify.

“Cobots are the bridge technology—keeping human decision-making central while automating the heavy lifting.” — Dr. Miguel Santos, Logistics Researcher, World Economic Forum

Warehouse Automation Benefits and Labor Shortage Solutions

Throughput gains by speeding repetitive steps while humans focus on exceptions and quality.

Ergonomic improvements that reduce strain injuries and injury-related downtime.

Consistency in packing, labeling, and kitting without removing human oversight.

Implementation considerations

Successful deployments start with ergonomics and safety certifications, then invest in staff retraining and change management—often the biggest hurdles. Leaders track KPIs like labor-hours saved, pick accuracy, and downtime, rather than headcount reduction.

Real-world applications and ROI

Common use cases include grocery bagging lines, e-commerce piece-picking, and automotive parts assistance at kitting benches. Compared with traditional industrial robots and Robotic Sorters Innovation projects, cobots typically have lower entry costs, with ROI often achieved in 18–30 months through combined throughput and ergonomic gains.

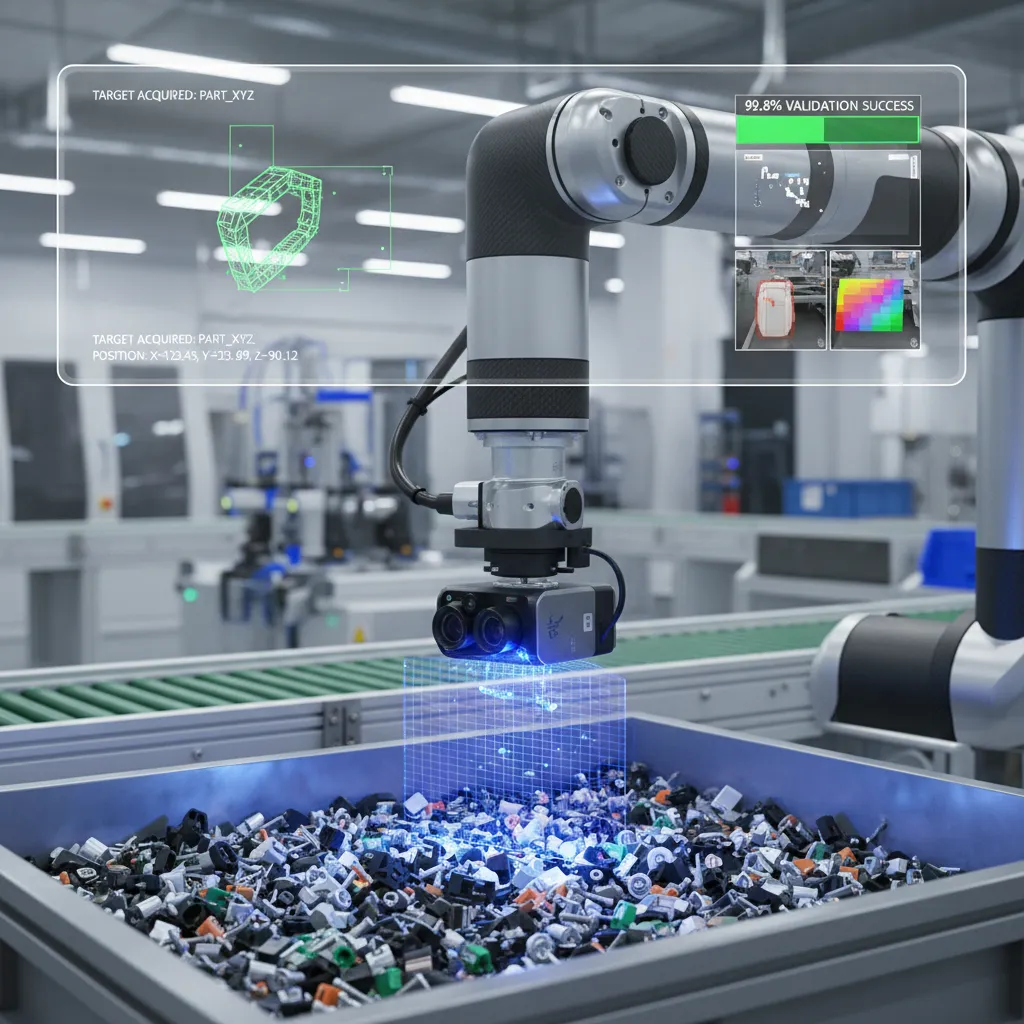

AI-Powered Vision Systems for Picking: Precision and Validation

How AI Vision Systems Make Picks Verifiable

AI-Powered Picking Systems combine deep learning cameras with depth sensors and weight checks to identify SKUs, confirm quantities, and validate each pick in real time. Instead of relying only on barcode scans, AI Vision Systems recognize packaging, labels, and item shape—even when items are partially occluded—then guide Robotic Picking Systems or human pickers with on-screen prompts and exception alerts.

Karen Patel, Head of Product, MetaOption Logistics: "Deep learning vision turns a subjective pick into a verifiable event—transforming quality control at scale."

Benefits: Fewer Mispicks, Faster Training, Better Traceability

Accuracy gains: Industry findings report up to a 72% drop in mispick-related returns after AI pick validation.

Onboarding speed: Visual guidance helps temporary staff reach target rates faster during peak seasons.

Audit-ready data: Time-stamped images and events improve traceability for customer claims and compliance.

Implementation Considerations and ROI

Performance depends on data quality and labeling, plus diverse images for SKU changes, reflective packaging, and seasonal variants. Facilities should standardize lighting, integrate with barcode/RFID and WMS workflows, and address privacy rules in camera-covered zones. Best throughput gains come when vision is paired with AMRs or cobots for end-to-end pick-and-transport—an AI Force Multiplier for supply chain robotics. Mid-to-large sites often see ROI in 12–24 months.

Digital Twins: Virtual Testing, Optimization, and Scenario Planning

What it is and how it works

Digital twins are live, virtual replicas of a warehouse that mirror the WMS/WCS, conveyors, supply chain robotics fleets (including AMRs), and IoT sensor signals. By combining Real-Time Data Visibility with simulation, teams can stress-test layout, staffing, replenishment rules, and robot traffic before changing the physical site—an increasingly practical approach within Warehouse Automation Trends for 2026.

“Digital twins convert intuition into quantified scenarios—letting teams test decisions without the real-world disruption.”

Dr. Elena Roos, Senior Systems Engineer, Numove Group

Key benefits for operations leaders

Faster design changes with fewer on-floor trials and less upgrade downtime.

Capacity planning using “what-if” models for same-day delivery spikes, nearshoring shifts, or supplier disruptions.

Sustainability gains by optimizing travel paths, energy use, and equipment schedules.

Predictive Maintenance AI becomes more reliable when twin models include equipment health and cycle counts.

Implementation considerations and ROI

Success depends on clean integration across WMS/WCS, robot telemetry, and IoT data, plus ongoing model calibration and governance so simulations stay current. In practice, digital twins reduce rollout risk and shorten time-to-deploy for complex changes; savings vary, but improved throughput forecasts and fewer disruptions often justify the investment.

Real-world applications

Grocery operators rehearse seasonal surges, e-commerce sites validate new AMR routes and pick waves, and automotive parts warehouses tune robotic sorter logic before go-live.

Warehouse Drones: Inventory Management from the Air

What warehouse drones are and how they work

Warehouse drones are autonomous or semi-autonomous indoor aircraft that fly aisle routes to scan barcodes/QR codes and, in some setups, read RFID. Using onboard cameras plus SLAM (since indoor GPS is unavailable), they map racking, locate pallets, and push results to the WMS for near real-time inventory visibility.

Key benefits: AI-Driven Stock Counting and safer audits

AI-Driven Stock Counting can reach up to 99.9% accuracy when combined with barcode scanning and real-time tracking. Drones also reduce ladder-based manual counts and improve safety during high-bay inspections. Many sites report cycle counts shrinking from days to hours, freeing teams for exception handling and value-added work.

Implementation considerations (WMS integration is critical)

Indoor navigation: SLAM quality, obstacle detection, and lighting conditions.

WMS integration: clean location master data, scan formats, and exception workflows.

Operational rules: defined indoor “airspace,” ceiling height limits, and safety pilot periods.

Real-world applications and Warehouse Robotics ROI

Grocery DCs use drones for fast aisle checks after promotions; e-commerce sites run large-scale cycle counts; automotive plants audit spare-parts cages without stopping lines. For Lights-Out Operations, some teams schedule flights overnight.

Sofia Martins, Head of Automation, The Feed: "Drones turned our weekend stock-count marathon into a single overnight job—accuracy and morale improved in one fell swoop."

With labor savings and fewer stockouts, Warehouse Robotics ROI often arrives quickly when drones replace repetitive counting and focus people on resolving discrepancies.

Real-World Examples: Retail, E-commerce, and Manufacturing Case Studies

Retail Supply Chain Trends: Grocery pilots combining drones + AMRs

A regional grocery chain paired warehouse drones for cycle counts with AMRs for tote movement to cut weekend stock reconciliation time and improve same-day fulfillment readiness. Teams reported near-real-time visibility, aligning with Warehouse Automation Trends showing early adopters gain measurable ROI and resilience. As one leader noted, the goal was capacity—not replacement.

Ethan Johnson, Head of Logistics, Regional Grocer: “We didn’t automate to cut people out—we automated so our small team could do more meaningful work.”

Supply Chain Innovations in e-commerce: AI picking + cobots reduce returns

High-volume fulfillment centers integrating AI picking systems (vision validation) with collaborative robots reported a 72% drop in mispick-related returns and faster onboarding of seasonal hires through guided workflows. Many programs used Robotics Integration Adoption via RaaS, enabling 3–5X faster deployment than traditional capex rollouts, according to industry reporting.

Manufacturing/automotive: kitting automation and autonomous transport

Automotive logistics pilots, including Isuzu Motors, are testing autonomous trucking with a stated goal of commercial Level 4 capability by 2027, alongside robotic kitting tied to assembly-line demand signals. These cross-industry pilots validate robotics in both SKU-diverse and high-volume environments, reducing line stoppages and improving safety—autonomous forklift operations are cited as up to 70% safer in some deployments.

Implementation Guide: How to Start with Robotics

1) Assess the Inbound Automation Frontline

Start by mapping inbound, storage, and outbound flows to find high-frequency, high-labor tasks: transport (AMRs), assisted picking (collaborative robots and AI picking systems), and counting (warehouse drones). Prioritize areas with repeatable travel paths and stable SKU profiles—common in grocery replenishment, e-commerce putaway, and automotive kitting.

2) Pilot for RaaS Deployment Acceleration

Run a modular pilot to reduce risk and speed time-to-value: one zone, one shift, one workflow. Capture baseline KPIs before go-live, then compare weekly.

Picks/hour, mispick rate, cycle-count accuracy

Labor hours, downtime, safety incidents, energy use (ESG)

Typical pilot timeline: 3–6 months.

3) Integrate to Improve Robotics Integration Adoption

Plan WMS/WCS connections, task orchestration, and data flows (locations, inventory status, exception handling). Define safety rules, pedestrian interactions, and training so robots support teams rather than replace them.

4) Finance for Warehouse Robotics ROI

Build a 12–36 month model comparing capex vs. opex, including RaaS, leasing, uptime, maintenance, and peak-season staffing. Practical tip: start with cobots or AMRs in modular RaaS packages to shorten payback and reduce technical debt.

5) Scale with Digital Twins

Use digital twins to test layouts, charging, and congestion before staged rollouts. Scale timeline: 6–24 months.

"The cheapest automation is the one you actually roll out—so start small, measure, and iterate." —Aisha Rahman, VP Operations, Hy-Tek Logistics

Conclusion: The Future of Human-Robot Collaboration

Warehouse Automation Trends and Supply Chain Resilience

Together, AMRs, collaborative robots, AI picking systems, digital twins, and warehouse drones are shaping the next wave of Warehouse Automation Trends. This is not a “lights-out” promise for every site, but a practical path to Supply Chain Resilience: robots handle repeatable travel, scanning, and picks, while people manage exceptions, safety, quality, and continuous improvement. As Dr. Priya Menon, Supply Chain Strategist, notes:

"Automation will reframe jobs—not eliminate them—creating roles that lean harder on judgment, systems oversight, and continuous improvement."

AI Robotics Convergence and the Physical AI Supply Chain

In 2026, Supply Chain Innovations are increasingly driven by AI Robotics Convergence, where fleets learn from shared data and digital twins reduce risk before changes hit the floor. Adoption is also expanding into mid-sized warehouses as RaaS models lower upfront costs and speed ROI. Beyond the four walls, autonomous trucking is moving toward Level 4 commercialization targets by 2027 (Isuzu Motors), tightening the link between automated yards, docks, and fulfillment.

What 2030 Could Look Like—and What to Do Next

By 2030, a same-day micro-fulfillment hub may run with AMRs feeding cobot pick stations, drones validating cycle counts, and a digital twin balancing labor and throughput in real time—approaching selective Lights-Out Operations during stable demand windows. The best next step is a 90-day pilot on one process, measuring picks/hour, mispicks, and labor hours, and scaling in phases with clear upskilling plans.